For many users, moving money from Chime to the Cash App is a routine task that helps them efficiently handle their personal finances. You could be paying for services using a group or personal account or just wish to move money between accounts, so you had better know how to do that quickly and smoothly. This tutorial is extremely simple and will help you quickly connect your Chime account to the Cash App to make payments. We will cover everything from linking your bank accounts to using your Chime debit card and the “Pay Anyone” feature. Further, we will discuss the fees and provide tips for a smooth transfer.

Quick Solution

To move money from the Chime to Cash app:

- In the Cash App, open “Banking” through the menu and click the “Add Cash” button.

- Press “Add Debit Card” and tell it your Chime debit card information.

- Enter the amount you want to transfer and verify by clicking on “Confirm.”

Can You Send Money to the Cash App From Chime?

Yes, you can send money to the Cash App from Chime. There are a few different ways to transfer money from Cash to chime, and it offers a fast and confined payment process. An account linking between Chime and Cash App has to be initiated first to cash out the money between the two accounts. You can also use the Cash App Debit Card for sending and receiving money between different platforms.

Sending Money From Chime to Cash App

You can send money from Chime to the Cash App instantly! There are easy and short methods to transfer money from your Chime account to the Cash App, like one-time password linking, the Chime Debit Card, the Pay Friends feature, etc.

Here’s how to transfer money and link your accounts to experience it with ease and just a couple of clicks:

Method 1: Adding Your Chime Debit Card to the Cash App

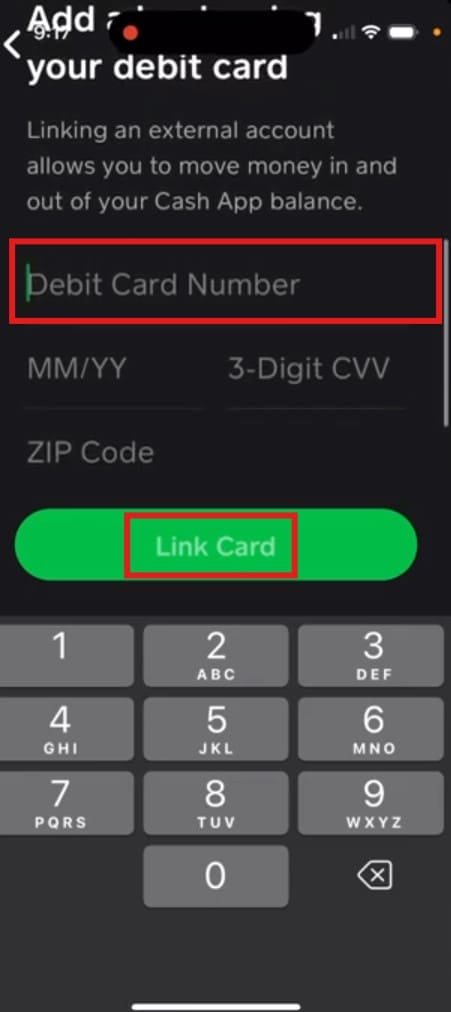

In this method, we will show you how to connect your Chime debit card to the Cash App in a few simple steps. You can easily transfer money from your card to any recipient who can receive it instantly. For this:

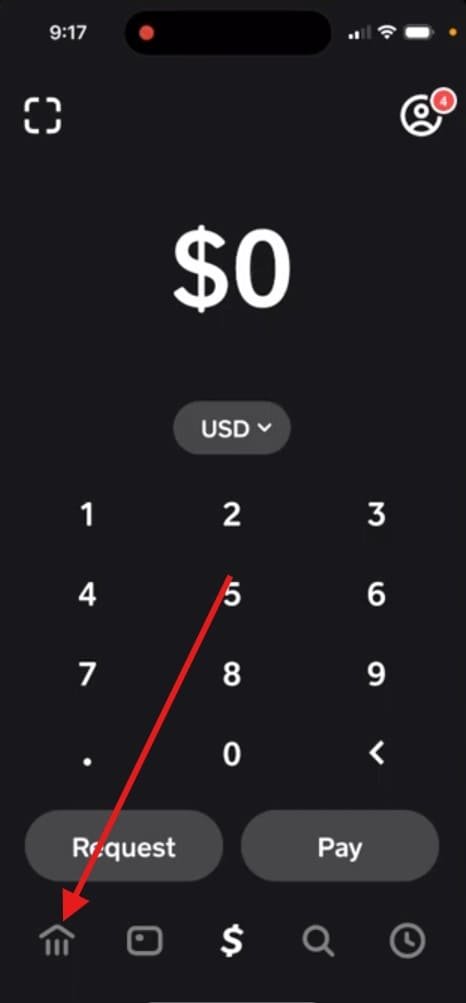

- Tap on the Cash App icon on your device.

- Touch the banking icon, from the left side of the screen.

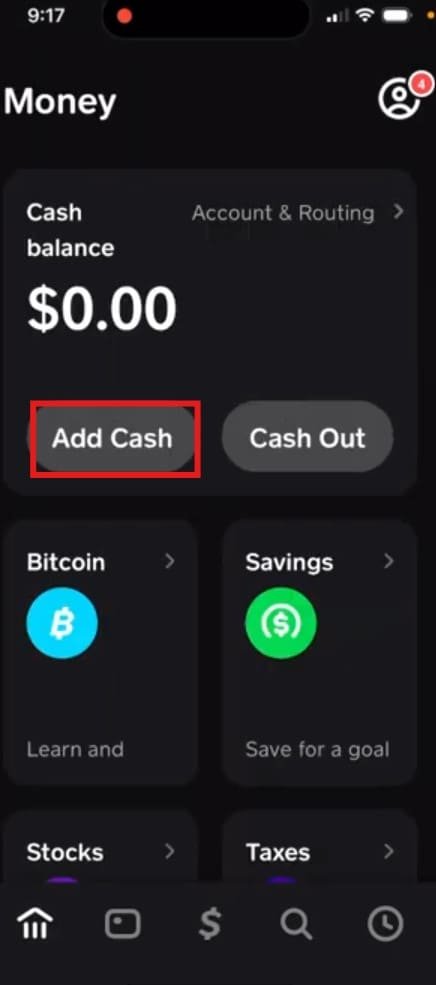

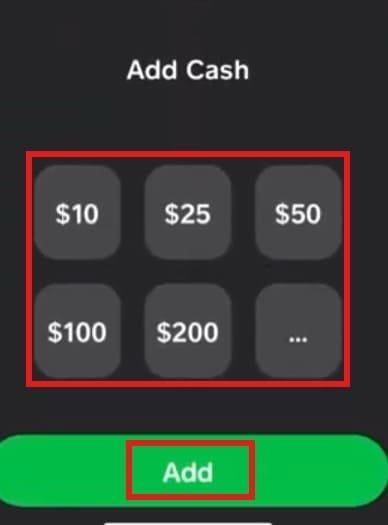

- Select “Add Cash.“

- Enter the amount you want and click on the “Add” option.

- Enter your debit card number and its information.

After this, your debit card is linked to the cash app, and you can send the money through it.

Method 2: Linking Your Bank Accounts to the Cash App

You can add your Chime bank account to the Cash App for rapid money transfers.

Here’s how you can do this:

- Open the Cash app on your smartphone (Android or iOS devices).

- Tap the bank icon in the lower left corner of your mobile screen.

- Tap “Add a Bank” and then press the “Link Bank” option.

- Enter your Chime bank account details (usually the routing and account number).

Once you have successfully connected your Chime bank account to the Cash app, you can move cash from Chime to the Cash App and vice versa without any issues.

Method 3: Use Chime’s Pay Anyone Transfer Feature

Chime’s Pay Anyone feature is a user-friendly interface that allows you to directly transfer payment to someone’s Cash App account. Here’s how you can easily transfer funds to anyone’s Cash App account:

- Open the Chime App on your device (iPhone or Android).

- Select “Move Money” from the appeared menu, and then press the “Transfers” button.

- Select the “Pay Anyone” feature from the appeared pop-up.

- Enter the recipient’s Cash App email or phone number.

- Type in the amount and then press “Send.”

This function is convenient for sending money directly to someone’s Cash App account.

How Much Does It Cost to Send Money from the Chime to Cash App?

Transferring money from Chime to Cash App is mostly free of charge if you use the standard transfer method. After all, a small fee (usually 1-3% of the transfer amount) will have to be paid for instant transfers via a debit card.

Make Low-Cost International Transfers with Wise

Wise (formerly TransferWise) is a great option for sending money internationally. It offers lower fees as compared to other services (like the Chime and the Cash apps) and provides clear information about your transfer. Wise provides low billing for transactions in currencies at almost 97% more competitive rates than other banks and instant services.

Transfer Fee Comparison: Chime vs. the Cash App vs. the Dave App

- If you use Cash App, you will have to bear a small fee of 1.75% of the amount you transfer.

- Venmo charges 1.5% of the total amount.

- PayPal charges 1% of the transferred amount.

- The Dave app charges nothing but requires a $1 subscription fee.

Conclusion

Transferring payments between Chime and Cash App is a legal, easy-to-follow procedure that offers you numerous options. If you connect your bank accounts, you can use your Chime debit card, or you may take advantage of Chime’s Pay Anyone service; the process is pretty much clear. Pay attention to potential charges for instant transactions and evaluate Wise for the cheapest international transfers.

FAQs: How to Move Money from the Chime to Cash App

Can I send money from Chime to Cash App instantly?

Yes, you can send money from the Chime to Cash app instantly. No matter what time of the day or night, as well as weekends and holidays, the Cash app will still allow you to enjoy the benefits of instant transfers. The money will be credited to the receiver’s Cash App account promptly. To use instant transfers, you’ll need to have a valid debit card linked to your Chime account, and there is no transfer cash fee.

How About the Costs of Sending from the Cash App to Chime?

The Cash App levies a small fee of 1.75% of the transferred amount, plus a minimum of $0.25 for the same-day money transfer. If you choose the standard transfer, then it is free. Whereas Chime does not charge any fee for instant deposits. Furthermore, you might be charged a small fee if you are using a debit card to top up your Cash App account.

How long does it take to transfer money from Chime to the Cash App?

Moving money from the Chime to the Cash App is fast and convenient. You might have seen transfer time insights on different options. The ones that are transferred almost immediately usually only take a few minutes. Regular transfers are generally finished within a few days; however, they can take up to 1-2 business days. Please, keep in mind that the transfers may be postponed if any more verification is required.